How We Built a Better Crypto Adoption Framework

Most studies of crypto adoption treat users and non-users as simple categories, overlooking the nuance and complexity in how people decide whether to participate. Real understanding comes from examining what happens in the messy middle between these segments. ◻️

Recent research by Fitz and Saunders (2025) has reshaped how scholars think about cryptocurrency adoption. Drawing on the Theory of Reasoned Action (Fishbein & Ajzen 1975; Ajzen & Fishbein 1980), their study found that the psychological and contextual factors driving people to consider owning cryptocurrency differ meaningfully from those that drive actual ownership. The implication is straightforward, yet significant: interest and adoption are fundamentally distinct, and need to be studied that way.

At Protocol Theory, we agree with this premise and it aligns closely with what we have observed across our global consumer datasets for some time. But in our view, it doesn’t go far enough.

Why the Middle Matters

Most consumer adoption studies divide people into three broad categories: users, considerers, and non-considerers. Users are those who already use, own, or regularly engage with the product or technology (in this case, crypto). Considerers are people who have not yet adopted but are actively considering it, while Non-considerers are those who express little or no openness to adopting at all.

While intuitive, this framework oversimplifies the behavioral and psychological complexity underpinning how people evaluate, hesitate, and ultimately decide to participate in crypto. Within the “considerer” group, for example, some are actively comparing options, while others are only passively or vaguely open to crypto but not yet ready to fully engage. Treating them as one group obscures these (and many other) crucial differences, ultimately undermining marketing, product development, go-to-market, and growth strategies.

In our research with some of the world’s leading digital asset, Web3, and fintech brands, we have consistently seen that adoption rarely follows a straight line. People move between stages of curiosity, skepticism, and trial in dynamic ways. Understanding this movement—rather than simply measuring ownership—reveals where strategies can most effectively drive real adoption.

A Structured View of Adoption

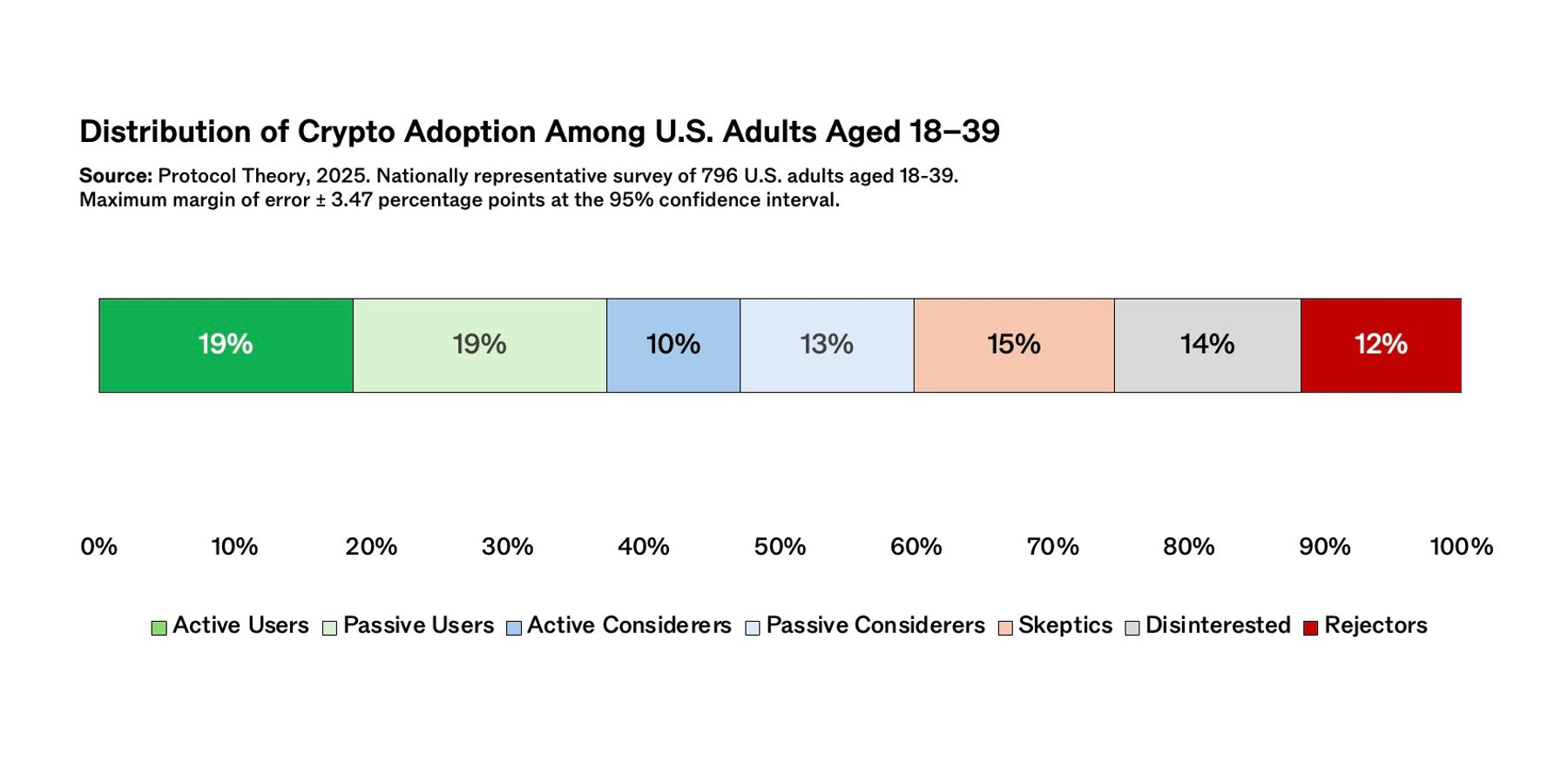

To better reflect these dynamics, we developed a behavioural segmentation framework that divides individuals into seven categories along the adoption continuum:

- Active Users – Regularly use and engage with crypto.

- Passive Users – Hold crypto but engage infrequently.

- Active Considerers – Currently exploring or comparing options.

- Passive Considerers – Open in principle but not yet researching or deciding.

- Skeptics – Undecided, constrained by risk perceptions, trust, or personal context.

- Disinterested – Uninvolved and see no clear benefit.

- Rejectors – Explicitly opposed, often for moral or ideological reasons.

These segments—which can be readily determined at the country, market, or sub-population level—are distinct, hold relatively stable under consistent macro and socioeconomic conditions, and respond differently to messaging, product design, and motivational triggers. Together, they provide a significantly richer and more actionable understanding of how crypto adoption actually happens.

Sentiment and Drivers Vary by Segment

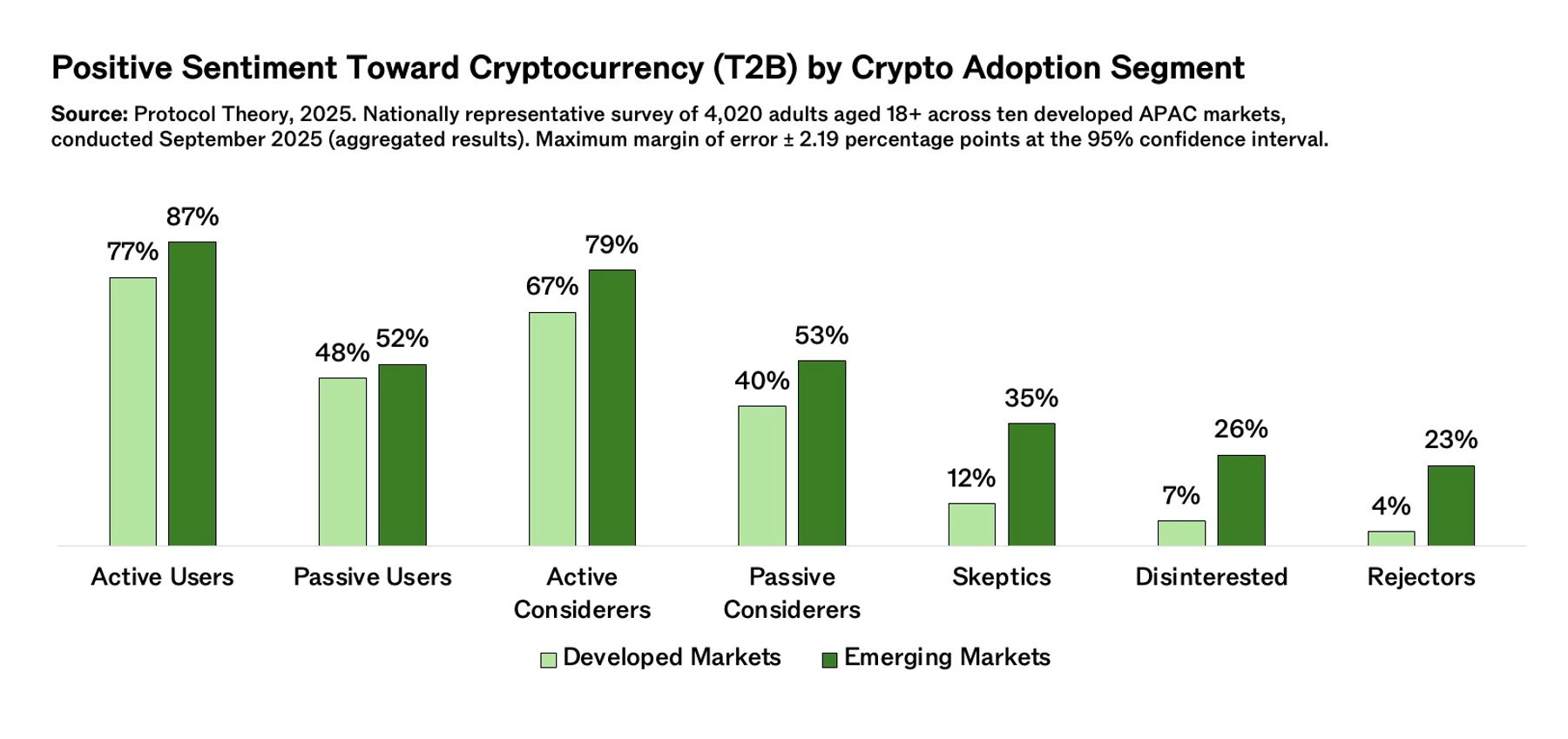

Across developed markets, sentiment toward cryptocurrency varies sharply by stage.

- Active Users: 77% express positive sentiment.

- Passive Users: 48%.

- Active Considerers: 67%.

- Passive Considerers: 40%. Among non-adopters, positivity drops to 12% for Skeptics, 7% for the Disinterested, and 4% for Rejectors.

Motivations differ as well. Active Users and Active Considerers are primarily driven by investment opportunity (57% and 40%), followed by inflation protection (36% and 28%) and payments or transfers (22% and 23%). This alignment shows that many Active Considerers are already psychologically close to adoption. In contrast, Passive Users remain largely financially motivated (71%) but less engaged with practical utility, reflecting more speculative participation.

Among non-adopters, the biggest barriers are low trust and limited understanding. Around one-fifth of Passive Considerers cite these reasons, rising to over one-third among Skeptics and more than 40% among the Disinterested and Rejectors. Many also express a continued preference for traditional finance.

Taken together, these findings illustrate that adoption depends on distinct behavioural and psychological mechanisms within each group. Effective strategy requires understanding how these mechanisms interact—and tailoring products, experiences, and communication accordingly.

Applying the Framework

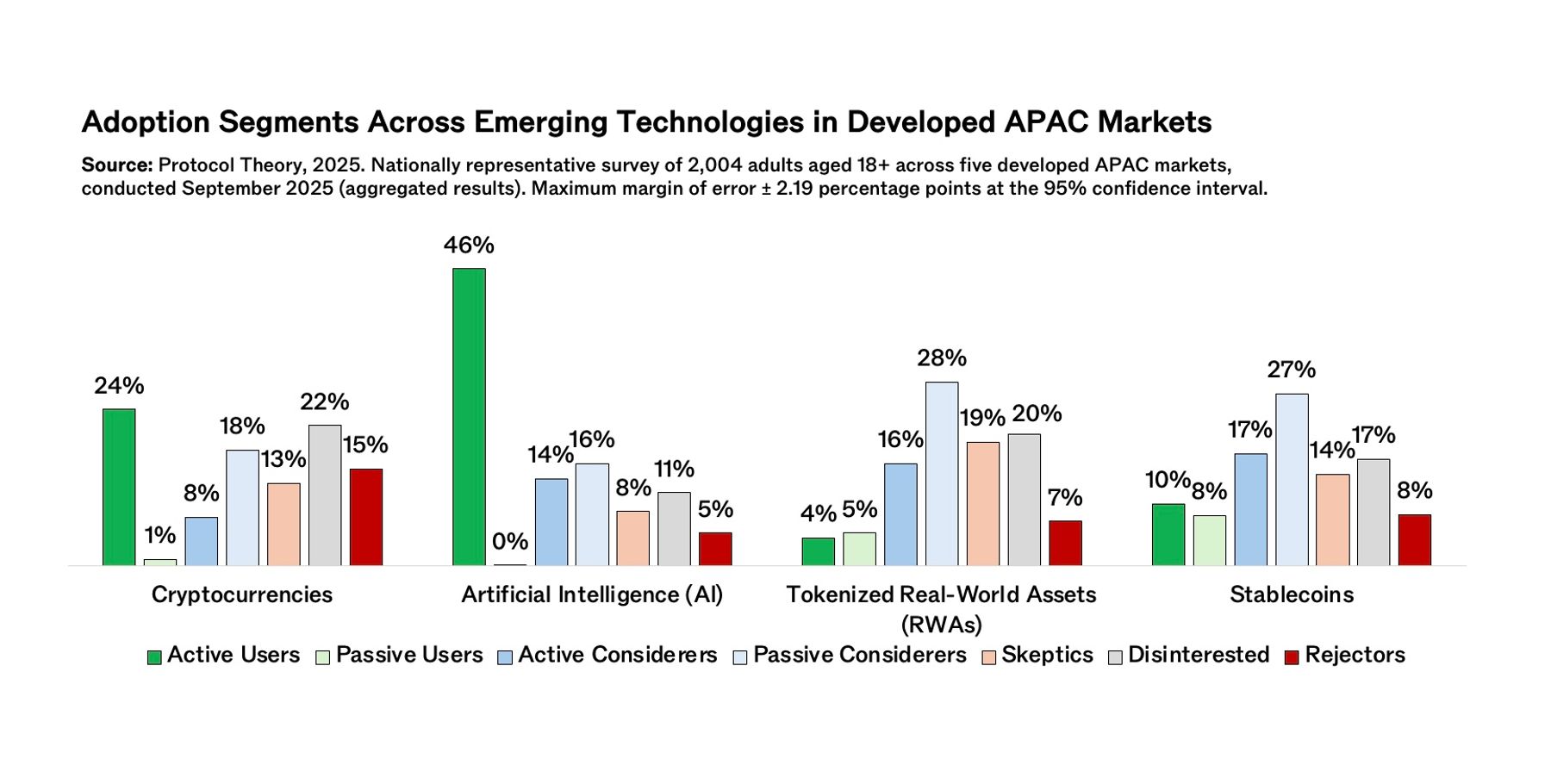

Applying the framework across categories shows how adoption takes different forms depending on the technology. Artificial Intelligence (AI) has by far the largest proportion of Active Users, reflecting its accessibility and practical integration into daily life. Cryptocurrencies, while more established, display a more polarized profile—one marked by a strong active base but also sizeable groups of Skeptics, Disinterested, and Rejectors.

Stablecoins and Tokenized Real-World Assets (RWAs), in contrast, are dominated by Considerers, particularly Passive Considerers, indicating widespread curiosity yet limited participation. These categories have considerable potential energy in the market, but adoption remains constrained by uncertainty, usability, and perceived relevance.

Across all sectors, the pattern reinforces that adoption potential depends not on awareness or market size, but on how engagement is distributed across segments. Understanding these distributions allows for more precise strategy—by identifying where education, trust-building, and usability improvements can most effectively convert interest into sustained participation.

Conclusion: From Interest to Impact

Viewing crypto adoption through this behavioural lens redefines what progress means. It moves beyond static ownership counts to the psychological forces that shift people from curiosity to commitment.

The seven-segment framework makes those shifts observable and measurable. It identifies where intent is forming, where comprehension or trust breaks down, and where design or communication can accelerate conversion.

By applying evidence to understand how people think, feel, and decide, the crypto industry can focus on what truly matters: transforming latent curiosity into confident participation and building a more inclusive digital economy. ◼️

Want to know what drives real adoption in your market?

Protocol Theory partners with product, marketing, and go-to-market teams to turn human insight into growth — helping emerging-tech brands build better products, stronger positioning, and smarter strategies.

Join Protocol Theory’s global community of technology, finance, and innovation leaders turning evidence into advantage.

References:

1. Ajzen, I., & Fishbein, M. (1980). Understanding attitudes and predicting social behavior. Prentice-Hall.

2. Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention, and behavior: An introduction to theory and research. Addison-Wesley.

3. Fitz, E. B., & Saunders, K. L. (2025). A behavioral approach to cryptocurrency adoption in the United States (Version 2). Department of Political Science, Colorado State University. https://doi.org/10.31234/osf.io/yquzs_v1

About the author

Jonathan Inglis

Jonathan Inglis is the founder and CEO of Protocol Theory, the world's leading consumer insight, analytics, and strategic consulting company dedicated to Web3, AI, and emerging tech. He has over a decade of experience collaborating with global brands to help them better understand users, consumers, and markets via actionable, evidence-based consumer insight.